Implementation of PAMR and MAMR portfolio management algorithms for online portfolio management and analysis of cryptocurrency assets.

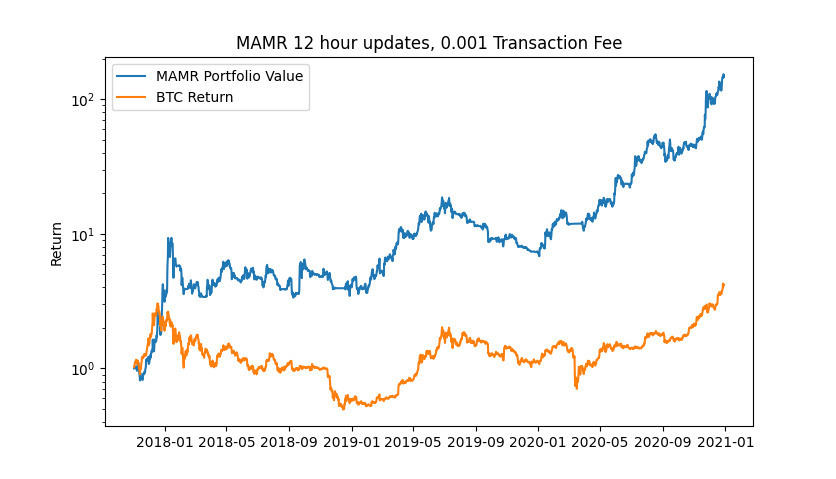

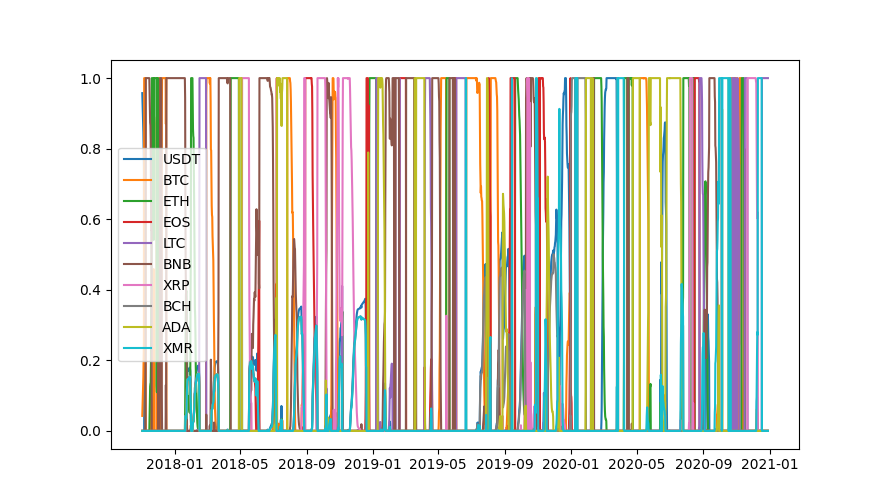

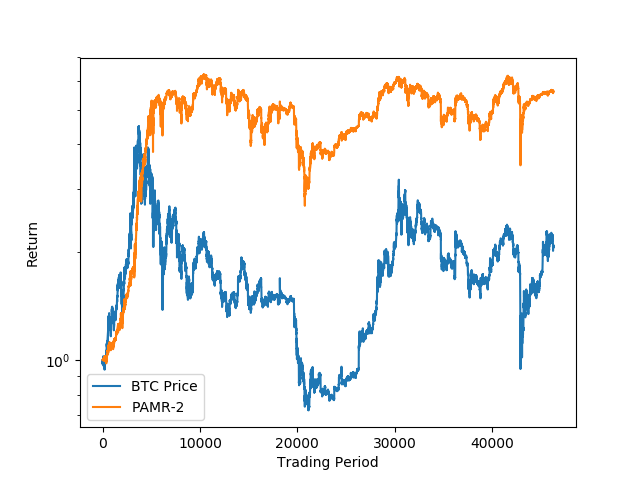

The scripts MAMR.py and PAMR.py simulate the returns that the portfolio selection algorithms would have achived had the algorithm been running. We see that MAMR outperforms PAMR in general, although parameter fitting has only been done by eye - no system has been implemented (yet). The MAMR implementation differes slightly from the paper by using a different moving average for the return prediction which empirically enjoys better results.

Parameters fitted to maximise the mean daily return, algorithm runs every 30 minutes

pip3 install requests numpy scipy

git clone https://github.com/alfredholmes/Binance-Portfolio-Management.git

cd Binance-Portfolio-Management

python3 data/get_candles_spot.py

python3 PAMR.py

python3 MAMR.py

In general MAMR outperforms PAMR for cryptocurrency portfolios.

Li, B., Zhao, P., Hoi, S.C.H. et al. PAMR: Passive aggressive mean reversion strategy for portfolio selection. Mach Learn 87, 221–258 (2012). https://doi.org/10.1007/s10994-012-5281-z https://link.springer.com/content/pdf/10.1007/s10994-012-5281-z.pdf

Peng, Zijin & Xu, Weijun & Li, Hongyi. (2020). A Novel Online Portfolio Selection Strategy with Multiperiodical Asymmetric Mean Reversion. Discrete Dynamics in Nature and Society. 2020. 1-13. 10.1155/2020/5956146. http://downloads.hindawi.com/journals/ddns/2020/5956146.pdf